Ce matin, je partage avec vous les conclusions d’une enquête effectuée par Ira Kay et Blaine Martin, pour le compte de la SEC, et parue dans la revue Pay Governance.

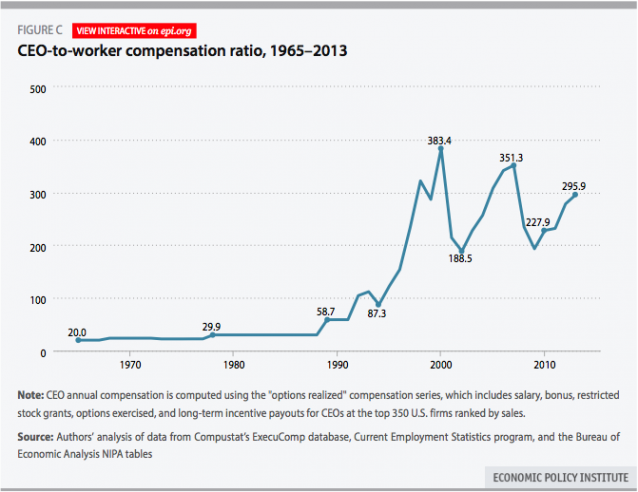

Quelle part de l’accroissement de l’inégalité des revenus aux États-Unis a été occasionnée par les rémunérations « excessives » des CEO ? Cette inégalité est-elle attribuable à une défaillance de la gouvernance des sociétés ?

Le mandat répond à certaines questions de la SEC, notamment :

Question 1 : Is the recent increase in US income inequality caused primarily by the increase in the number of public company executives in the top .1% of earners?

Question 2 : Alternatively, is the recent increase in US income inequality caused primarily by the increase in the aggregate pay levels of public company executives in the top 1% and .1% of earners?Image may be NSFW.

Clik here to view.Question 3 : Is CEO pay aligned with the performance of their employer?

Question 4 : Have corporate governance failures caused excessive executive compensation levels at public companies, thus exacerbating the inequality issue?

Question 5 : Are shareholders dissatisfied with the US executive pay model?

Cet article apporte des réponses qui surprendront probablement les spécialistes de la gouvernance. Les auteurs tirent des conclusions très utiles pour les comités de rémunérations à l’occasion de l’évaluation de la paie de leurs CEO. « The conclusion of our research is that relatively high executive compensation at public companies, allegedly enabled by compliant boards, is not the primary explanation for rising income inequality in the US ».

Voici quelques considérations à l’intention des comités de rémunération :

Ensure that competitive executive compensation opportunity levels are monitored annually against the median of an appropriately-sized peer group. This will provide a robust context for the CEO pay ratio.

Ensure that executive compensation program design provides appropriate pay-for-performance linkage, including setting challenging performance goals and providing the majority of compensation in long-term equity.

Apply best-practice compensation policies including robust stock ownership guidelines, clawback provisions, and prohibitions on hedging and pledging company shares to further link executive income and wealth to the performance of the company.

Maintain strong corporate governance practices including nominating directors using an independent Nominating Committee, using independent compensation consultants and legal counsel, and holding executive sessions at each Compensation Committee meeting.

Ensure that all employees are competitively and appropriately paid relative to the profitability, fairness and economics of the company.

Consider whether the Compensation Committee should review supplemental analyses related to the CEO pay ratio and broad-based pay practices (e.g., comparison of executive versus broad-based pay increases, review of number of employees covered under benefit programs, and review of pay ratio and median employee data to peers).

Consider how the Company will address and explain the disclosure of the ratio of CEO to median employee pay in the 2018 proxy. Since supporters of the CEO pay ratio believe that this disclosure will reduce “excessive” CEO pay caused by weak governance, companies may need to be explicit in responding to this theory. The data and analysis presented here could help in this regard.

The SEC’s Madated CEO Pay Ratio in the Context of Income Inequality : Perspectives for Compensation Committees

Key Takeaways

While the income inequality controversy started as a sociological and public Policy debate, Compensation Committees should have a strong understanding of the Relationship between public company executive compensation and income inequality.

The impending disclosure of the ratio of CEO to median employee pay in 2018 proxy statements, as required Under Dodd–‐Frank, will dramatically bring such discussions into the Compensation Committee in the near future. Supporters of the CEO pay ratio believe that this disclosure will reduce “excessive” CEO pay and lower the pay multiple.

Many “overpaid” executives subject to weak boards and poor corporate governance for being the primary cause of US income inequality. This is not accurate. While corporate executives are paid well, public company executives represent a smaller portion of the highest .1% in more recent times than they did in the mid–‐1990s.

Additionally, for the top .1%, growth in public company executive compensation actually lags the growth in private company executive pay and finance Professional pay over the same 13–‐year time period.

Pay Governance’s analyses of realizable pay for performance indicate that pay–‐for–‐performance is operating among US companies.

Improvements in corporate governance practices combined with similar executive pay levels and designs for private company executives suggest that high levels of public company CEO pay are not the result of corporate governance failure.

Further, widespread investor support for say–‐on–‐pay votes in the past six years indicate broad investor support of the current executive compensation regime.

We make strong arguments that the CEO pay ratio for a particular company will be indicative of market–‐driven industry, size and performance factors, rather than a failure of corporate governance.

As Compensation Committees consider the context of inequality issues and executive compensation decisions, Committees should focus on robust corporate governance practices, independent advice, and the company’s strategy for addressing the disclosure of the ratio of CEO to median employee pay in 2018.

The complete publication, including footnotes, is available here.

Classé dans :Comportement, Formation des administrateurs, Gouvernance, Performance, Performance, Rémunération de la direction Tagged: Board of directors, CA, CEO, Comportements, Corporate governance, Direction, International, rémunération Image may be NSFW.

Clik here to view.

Clik here to view.

Clik here to view.

Clik here to view.

Clik here to view.

Clik here to view.

Clik here to view.

Clik here to view.